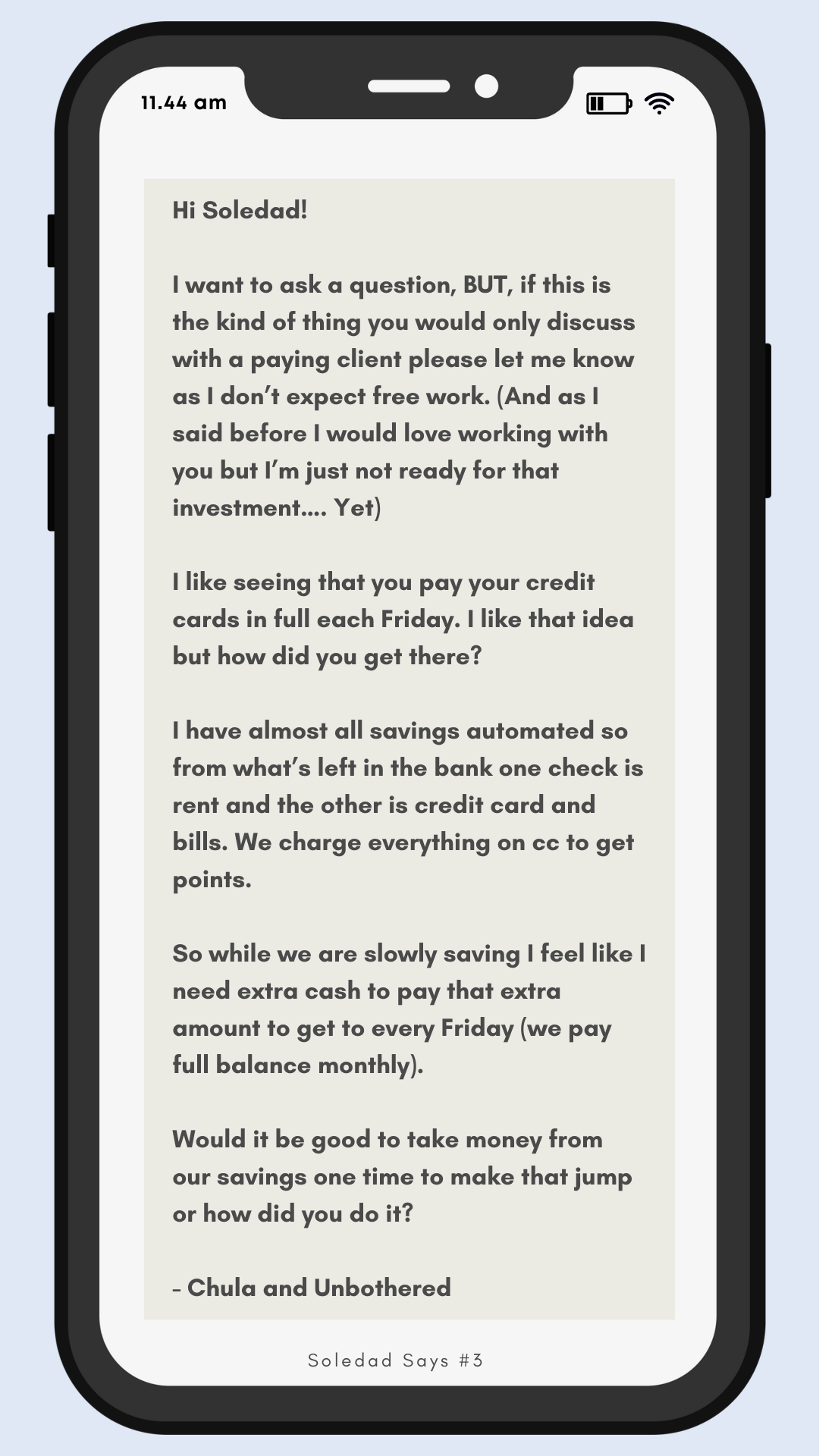

Help! I want to pay my credit cards in full weekly! (Soledad Says #3)

Jan 29, 2022

Dear Chula and Unbothered,

Thank you so much for being considerate of my time when asking me a personal question via Instagram. The reason I wanted to create this "Soledad Says" Series is to be able to answer great questions in depth. I'm glad you decided to participate anonymously!

It took me a while to finally get to the point where we could pay our credit cards in full every Friday. My budgeting journey started in May 2019. I tried zero-based budgeting and gave up after three days. Then I started again in June 2019. I made a decision that I would work at improving my budgeting skills poco a poco. I didn't expect perfection from myself but I did want to see that I improved each month.

By September 2019, I had paid off about $23k in student loans but still didn't feel like I was great at budgeting. It felt like a tedious chore and I resented husbae because while I tracked our spending he was playing with our children. 🤦🏽 I I eventually started tracking our spending while he was bathing the kids and that felt a little better. I I would light a candle put on some music and really enjoyed the alone time.

By January 2020, I considered myself the Chief Financial Officer of our familia and I set a goal that I would create a budget for every month in 2020 and track all of our spending. I would even share on Instagram pictures of my spending.

Then in February 2021, I stopped using the budget app I had used for several years to track my spending. When I stopped using the app, I found myself charging too much to our credit cards and not meeting my savings goals. I thought about just using my debit card for purchases but really wanted to earn passive income from my credit card rewards.

By April 2021, I was not tracking my spending and just set the goal to be able to pay my credit cards in full by the end of the month without having to dip into savings. In some ways, I was back to my pre-budgeting days of 2019 but I WAS investing towards early retirement and had automated our savings. Yet, I didn't like that I didn't have the extra cash flow to save for real estate with this system.

I needed to find a way to decrease our spending without having to track our spending. So I decided to set the goal of keeping half of one paycheck in our checking account at all times. For my family, this meant keeping $2,500 in our checking account at all times and if I got below $2,500, I considered it "over drafting."

Once we built that cushion, I started to pay our credit cards in full every two weeks. Sometimes this led to "over drafting," and as I reflected on my spending, I decided to accept that during that season of my financial journey I needed to spend more on present comfort than future goals. I even encouraged others to do the same here.

By September 2021, I thought I needed to go back to tracking my spending and I even shared a google sheet with my newsletter people so we could all do it together. But as my business grew and I had to start tracking business expenses, I no longer wanted to track personal expenses.

So I made the decision that I would just pay my credit cards in full every Friday no matter what. If that resulted in having less than half a paycheck in our checking account, that would be feedback not failure. If I needed to pull money from our emergency fund to make sure our checking account had that $2,500, that would be feedback not failure.

Now it's January 2022, and paying my credit cards in full each week is just a habit. I don't track my spending but I do review it weekly with cariño. (BTW I'm spending too much on Candy Crush 😩)

As you can see it took YEARS for me to get to this point, I hope this email allows you to figure out a system that works for you within 3 months. Here are some suggested next tips:

- Calculate the bare minimum you need to keep in your checking account as a cushion. One whole paycheck? Half a paycheck? A specific dollar amount?

- Use extra cash flow to build that amount in your checking account. This may mean sending less to your emergency fund.

- Calculate the maximum amount you should be able to spend on each of your credit cards a week and still pay them off in full. Use the formulas below to help you with your calculations

- (Paycheck after retirement contributions) - ($ for emergency fund) = $ left for expenses

- ($ left for expenses) - ($ for FIXED EXPENSES) = $ left for VARIABLE EXPENSES

- ($ left for VARIABLE EXPENSES) ÷ (# of weeks in a month) = Total amount that can be charged on ALL credit cards

- Consider only using one credit card for a month and paying it off weekly. Then you can start to use more credit cards to maximize your reward points.

- Allow yourself to be a beginner. Allow yourself to overspend and not give up on developing a new skill. Allow yourself to ask for help and get additional support.

I look forward to hearing about your progress and I'm excited to one day become your financial coach!

Todo con tiempo,

P.S. Please forward this email to anyone who could benefit from weekly emails about dinero. They can subscribe at this link.